Healthesystems embarked on its second annual collaboration with Risk & Insurance® magazine to survey workers’ compensation industry stakeholders about issues regarding the provision of medical care for injured workers. Our goal was to understand their current concerns and draw insights that will help inform the many crucial decisions that our customers and colleagues in workers’ comp make every day to ensure the best possible care for injured workers.

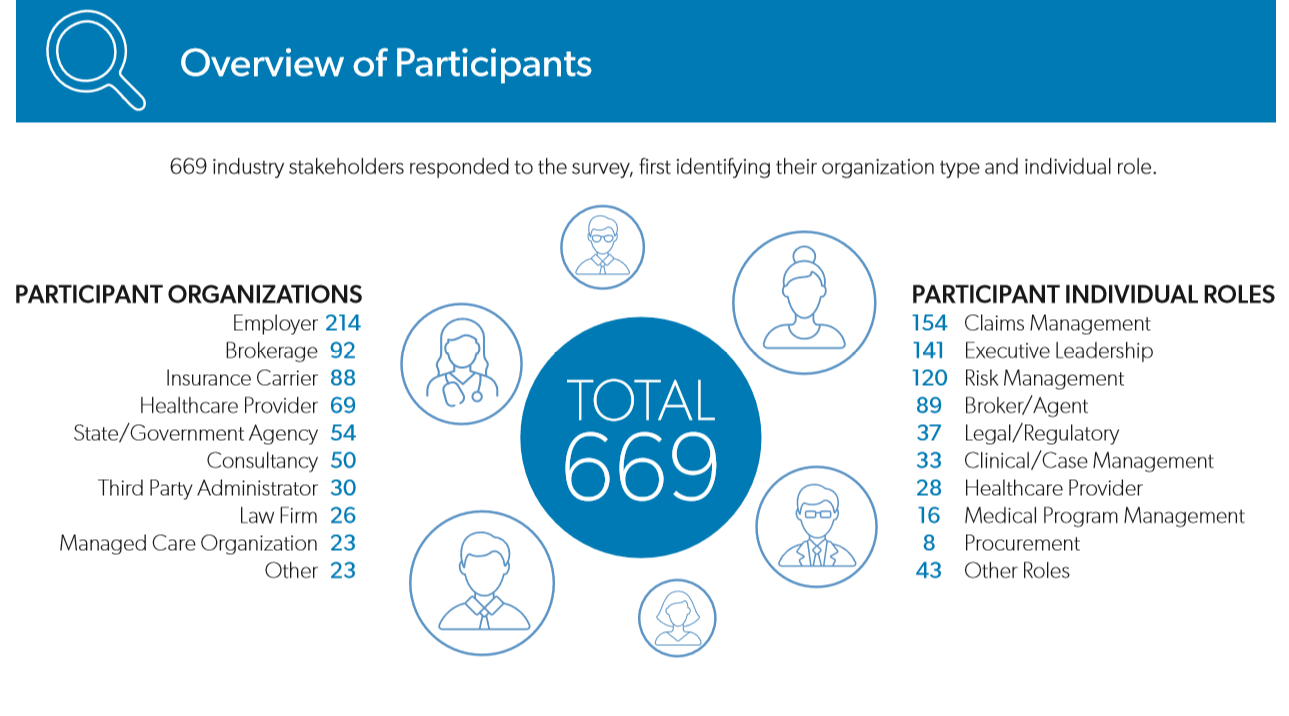

Conducted in-person at NWCDC 2019 and online through Risk & Insurance, the 2020 Workers’ Comp Industry Insights Survey drew responses from 669 industry stakeholders, all of whom first identified their organization type and individual role. This allowed us to analyze results collectively, while also examining the ways in which views varied between industry segments and professions.

Three issues stood out as being top-of-mind for the vast majority of participants: the changing workforce population; comorbidities/ poor worker health; and the increasing complexity of claims. With some minor exceptions, these were considered the top three challenges for our industry, an assessment that appears all the more accurate as the COVID-19 virus strikes workers’ comp. And we see clear connections between these challenges. For example, older workers, the most impactful population trend by a wide margin, are more likely to suffer comorbidities, which are a leading contributor to medical complications and complex medical claims.

Growing concern about the ability to manage claims was revealed in multiple incidences throughout the survey. For example, claims process/workflow automation was consistently selected as the #2 most important technical advancement over the next 3 – 5 years (telemedicine was #1). And over 80% of participants agreed that the greater complexity of claims is requiring more clinical decisions to be made during the claims management process. Those decisions put additional pressure on claims professionals and case managers already under heavy workloads, increasing the risk that something will be missed.

Arguably the biggest (pre-COVID-19) risk for workers’ comp programs over the past decade has been opioid abuse, but concern about opioids appears to be on the decline. Opioid abuse did not make it into the list of top 5 industry challenges in this year’s survey (as compared to #3 last year), nor did participants see it as a top health or claims risk. As an industry, we have made progress in curbing opioid abuse, but we still have work to do and it would be premature to claim victory. This view is apparently shared by insurance carriers who bucked the trend by ranking opioids/ substance abuse their #1 claims risk.

Post-traumatic stress disorder (PTSD) and other mental health conditions have surpassed opioids as a perceived challenge and risk. This is probably due to a combination of two factors: an increasing number of states expanding coverage for first responders and an overall increase in reported incidences of mental health conditions, driven in part by the large number of millennials now in the workforce who, according to certain studies, are more likely to experience and seek treatment for conditions such as anxiety and depression.

Escalating medical costs was the #1 challenge for survey respondents in last year’s survey, so we dug a little deeper this year and learned that containing hospital costs is the top priority overall, followed by prescription drugs and physician/professional fees. Responses to the cost question tended to vary, however, depending on the type of organization or individual role. For example, insurance carriers were more focused on prescription drug costs than hospital costs, and participants in clinical roles put physical medicine ahead of physician/professional fees.

While the overall trends revealed in the survey were consistent, results varied on some questions, depending on who was responding. For example, executive leaders were more concerned about legislative and regulatory changes than other participants, ranking it as their second-most-important challenge. Executive leaders also have more confidence in artificial intelligence as an important technology, ranking it as the second-most-important technology over the next 3-5 years, as opposed to other participants for whom artificial intelligence was not seen as important. Information technology and/or data analytics professionals were not among the survey participants and it is possible that executive leaders know more about how artificial intelligence is being applied in workers’ comp.

Medical program managers ranked opioids and substance abuse as their number one program challenge, in contrast to a number four ranking across all respondents. This is likely because medical directors and managers are keenly aware that opioid use is still prevalent and risky. Medical program managers were also more concerned than any other group about new and expensive medical treatments, possibly because they have greater insight into the efficacy and cost-benefit ratios of new drugs, devices, and therapies.

The type of organization participants worked for also seems to have influenced their perspectives, with insurance carrier participants expressing greater concern about opioids and substance abuse, as well as prescription drug prices, as compared to those from employers and government agencies. And claims professionals and case managers stood out in their selection of comorbidities as the number one claims risk, which came in at number three in the overall results. These variations may reflect their closer familiarity with claims and the factors that can drive them off course.

The aging workforce, and increased prevalence of comorbidities among both older and younger workers, are contributing to more complex claims, and now more serious complications for COVID-19 patients (almost 90% of COVID-19 patients admitted to the hospital suffer from comorbidities). And the aging workforce presents other challenges for workers’ comp. For example, the average worker age in the insurance and healthcare industries is also rising, and a wave of retirements will likely lead to a shortage of experienced people to process claims and care for injured and ill workers, just as demand is increasing.

Technology will help to bridge the gaps. Increased use of telemedicine in workers’ comp will help alleviate long wait times to see physicians and should also make those visits less expensive. Telemedicine has also proved to be an invaluable tool for providing access to care without risk of infection during the current pandemic.

Improved claims automation will allow claims professionals to focus their time and attention where it is most needed, help guide clinical decisions, and improve communications between the claims and care management teams. Enhanced data visualization and predictive analytics will be crucial in detecting and mitigating risks early in the claims process. And we should expect new risks, not only from dramatic events like the COVID-19 pandemic, but also from more commonplace occurrences.

We know from past experience that changes are often accompanied by unexpected consequences. New drugs to treat chronic pain brought the opioid crisis, and the current movement away from opioids could lead to other forms of inappropriate prescribing. Treating comorbidities may result in polypharmacy and the risk of adverse drug reactions. Medical innovations, such as biologics and new medical devices, present new opportunities for promising treatment alternatives, but also for fraud, waste, and abuse. And legislative changes, such as expanding coverage for PTSD and other mental health conditions will help many patients receive much-needed treatment but might also increase caseloads and costs.

The 2020 Workers’ Comp Industry Insights Survey shows us that workers’ comp professionals are keenly aware of the wide-scale changes taking place. Our job as industry leaders is, whenever possible, to anticipate the implications of those changes and prepare for them.