There’s high demand to control ever-rising healthcare costs, and fees for professional services and medical equipment continue to climb. While drug prices may dominate headlines, stakeholders across the healthcare spectrum know that a multi-pronged approach that touches on other high-cost aspects of healthcare is necessary to reduce overall medical costs.

Costs for ancillary products and services do not face nearly as much scrutiny as drug prices, and it is important to remember that whenever healthcare costs are reduced in one line of service, stakeholders have historically found ways to make up for lost revenue elsewhere, making the unraveling of fee schedules more important than ever.

A fee schedule is a listing of maximum fees that can be charged by providers who deliver healthcare goods and services when working on a fee-for-service basis. Fee schedules are designed to control costs, but their construction requires a delicate balance.

If fee schedules are set too low, providers have little financial incentive to provide services, potentially limiting patient access to care or leaving patients with low-quality care. If fee schedules are set too high, they do little to control costs as intended.

While designing fee schedules can be a challenge, they often help in the long run. States without fee schedules for professional services in workers’ comp experience prices 39-171% higher than states with fee schedules.1 However, the impact of fee schedules can vary depending on their composition.

For example, when Virginia introduced a workers’ comp fee schedule, overall prices paid for professional services fell 14%, but when Arizona adopted a fee schedule, there was an overall growth in average prices for services.1

While price increases are sometimes necessary with fee schedules to ensure provider incentive to supply workers’ comp patients with quality care, it is still in payers’ best interest to understand just how fee schedules work, how they are created, how they can be manipulated by certain parties, and what can be done to influence them.

Fee schedules determine costs by multiplying a relative value unit (RVU) by a conversion factor.

RVUs are measures that establish the work or resources required to deliver the product or service, capturing time, expertise, and other costs. While RVUs can vary, 31 states use RVUs established by the Centers for Medicare and Medicaid Services (CMS), which are known as the resource-based relative value scale (RBRVS). These RVUs are calculated with extensive research from study panels assembled by Harvard researchers.2

However, a given state may base their prices off a particular year’s edition of the RBRVS, or they may use a different RVU benchmark. Furthermore, states utilize different conversion factors from one another, as well as different conversion factors between lines of service. There is an endless level of diversity to fee schedule design, as different states face different challenges in managing care for their injured worker populations, and payers must understand these intricacies if they wish to control costs.

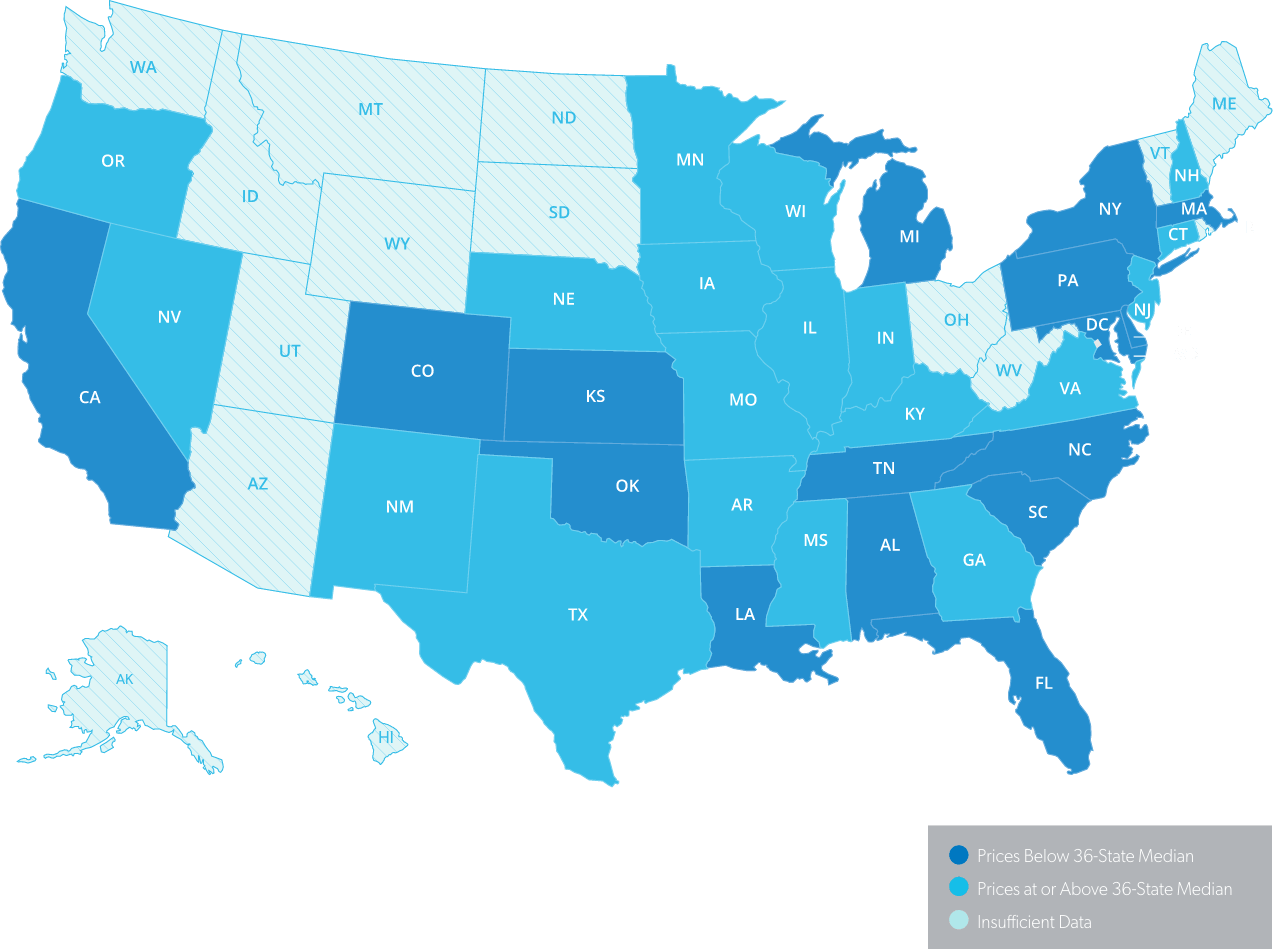

A total of 44 states have fee schedules, and there are a multitude of geographic factors that impact access to healthcare across the country. It is for this reason that fee schedule designs vary so significantly, which in turn diversifies prices paid for similar sets of services among different states.

One study examined fee schedule prices across 36 states, with prices ranging from 27% below the 36-state median to 164% above the 36-state median.1 While having such diversity is absolutely necessary to ensure that specific locales create enough provider incentive to give injured workers access to quality care, the sheer level of diverse rules across the nation makes it difficult to spot questionable practices.

It is imperative that payers understand just how fee schedules can vary from region to region in order to best monitor utilization, cost, and more.

The process for updating fee schedules varies by state, with a multitude of factors to consider.

Some states require legislative action to enact fee schedule changes, others require administrative rule changes or mandates from regulatory boards, or there may not be a formal process. Demand from payers and providers or the publication of key data and trends can also spur interest in updating fee schedules.

If fee schedules are required to fall in line with certain pricing benchmarks, such as those established by CMS, policy may dictate that whenever a pricing benchmark updates a particular fee schedule, the state must follow suit on that line of service, leaving fee schedule updates dependent on federal changes.

Striking a balance between too little or too many updates is a model that varies by state. Legislative language may require fee schedule reviews and/or updates on a regular basis. However, most states simply update only a few lines of service in a given year, updating different lines of service in another year. In states with less frequent updates, the changes they make could be far more significant, requiring closer attention.

Fee schedules are often tied to CPT (current procedural terminology) codes, and in some cases fee schedules require regular updates to maintain consistency with the most recent edition of codes published. When this isn’t the case, if a state uses an outdated set of CPT codes, demand for fee schedule updates may grow, potentially leading to change driven by stakeholders.

Beyond fee schedule variability between states, individual states may establish sub regions within their borders to further differentiate pricing by locale. Eight states in the U.S. have sub-state areas with different workers’ comp fee schedule rules, with anywhere from 2-32 divisions within a state.2 With more states considering the use of substate areas, keeping track of fee schedule rules may only grow more complex.

The confusing nature of fee schedules can lead to a lack of transparency where fraud, waste, and abuse run rampant. Fee schedules can be manipulated with ambiguous coding to inflate prices, increase the number of charges billed to payers, or utilize clinically unnecessary treatments.

According to a Healthesystems study, 20-40% of bills use miscellaneous codes, limiting payers’ visibility into true utilization and cost.3

By staying informed with the latest fee schedule proposals, payers can understand which potential changes may have the biggest financial impact on their claims, allowing payers to prioritize their efforts during calls for public commentary.

With the proper guidance and foresight, payers can gather data on utilization, clinical outcomes, and coding issues, providing decision makers with insight into how proposed fee schedule changes will impact real-world outcomes. These insights are often welcome by regulators, as they regularly request this type of testimony during the rulemaking process, holding public meetings or calls for commentary.

Payers can also take stock of current fee schedule language and composition to understand where opportunities for fraud, waste, and abuse exist, giving payers visibility into where they should intervene in their claims.

A strong Advocacy and Compliance partner can help payers keep track of the diverse range of fee schedule rules impacting their claims, along with guidance on how proposed updates will impact business operations.

Healthesystems’ Advocacy and Compliance team accomplishes this, while also maintaining the relationships necessary to gain insight into the rulemaking process and deliver more effective testimony and public commentary during calls for stakeholder feedback, oftentimes impacting final fee schedule rules.

When fee schedules are manipulated and true costs are not transparent, payers could do well to partner with a medical benefits manager that can:

There has been much talk in workers’ compensation about switching from the fee-for-service model of healthcare to a value-based care model. While defining and designing such a model is still a topic of debate, value-based contracting and reimbursement could replace fee schedules in states that allow payers and provider networks to make alternative agreements.

Healthesystems’ VP of Clinical Services, Silvia Sacalis, BS, PharmD, and EVP, General Manager of PBM Services, Matt Hewitt, discuss valuebased care in a video interview series conducted by Risk & Insurance magazine.

Visit healthesystems.com/insights to hear what our Healthe experts have to say about aligning metrics to measure outcomes, utilizing evidence-based guidelines to drive smarter utilization, and leveraging technology to accomplish this.