Sandy Shtab, Healthesystems AVP of Advocacy and Compliance, comments on regulatory activity around the country.

In this day of hashtags and buzzwords like “InsurTech” it is more important than ever that our industry think about innovation and how we can further leverage technology to mitigate risk.

Our workforce is changing, and we must adapt how we serve our injured workers. Most of our state laws were written or revised decades ago, when mail carriers were the only mechanism to deliver information. Today, instant messaging, text, email, and social media render snail mail nearly extinct. Yet even with technology so prevalent in how we exchange health and financial information, workers’ comp systems still require a hard copy form to be mailed to an injured worker or a wet signature to authorize a medical service or initiate a dispute resolution.

We need to evolve how we manage claims, deliver medical care, and work with state regulators to sustain our industry. It may be risky to innovate in workers’ comp, but it is even riskier not to, lest we become extinct like the Yellow Pages or Blockbuster Video. Look at the taxi industry as a cautionary tale. When rideshare became popular, cab companies took exception because they perceived a threat to their business model. To avoid a similar fate, we must realize that the status quo will eventually change; we can either choose to drive that change ourselves, or let someone else take the wheel.

So, what do we need to do to change regulation? We need to change our way of thinking and convince others to do so, too. And we can take those steps by opening dialogues across the industry.

In October, I was invited by the IAIABC to join their “Innovate or Die!” panel at the 104th Convention, which focused on how claims professionals, medical providers, and regulators must evolve their systems to stay relevant.

One panelist spoke of the need to minimize stakeholder burden by utilizing technology. Twenty years ago, some insurers eliminated paper in favor of scanning documents, incorporating emails and electronic faxes, calling it a win in the face of time and cost savings. But how much has technology evolved since then? Another panelist spoke to the unanticipated impacts of 24-hour coverage and the gig economy on insurers. Insurers are now more sophisticated and have more skin in the game. They want the ability to drive results and customize their programs, and the companies that can do this for them are the most successful.

I shared my thoughts on how our collective attention span is shrinking. Despite our connections in the virtual world, many of us are reluctant to answer an unknown phone number or listen to a voicemail, and many of us largely use text to communicate. While we must embrace technology, we also need to remember that there are still people on the other end who need service and attention, and we must temper technology with compassion.

How will workers’ comp look a decade from now? We can’t know exactly, but there will always be a need for compassionate, talented people who care about serving patients. Those are the people who will look for ways to improve the workers’ comp system. How those improvements happen is up to us, if we are thoughtful in our evolution, communicate well, and continue to work together to sustain a healthy and balanced system to help workers toward recovery.

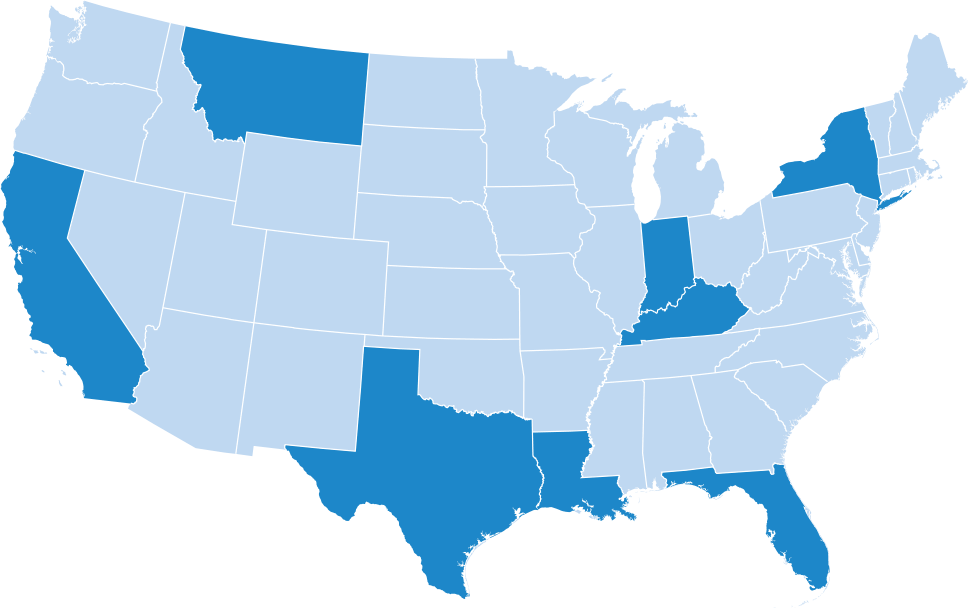

Several states have made legislative changes to their workers’ comp statutes to enable first responders to receive benefits for post-traumatic stress disorder (PTSD) as a compensable injury without having sustained any precipitating physical injury. While all states have some guidance to address “mental-mental” claims and standards for compensability, there is not much uniformity on those statutes, and with the growing focus on mental health and efforts to remove the stigma attached to mental disorders, a handful of states have taken a new approach to accepting and treating injured workers with a PTSD diagnosis.

States like New Hampshire, New York, Texas and Florida have all enacted laws which will ease workers’ access to indemnity and medical benefits for the treatment of a compensable PTSD exposure. First responders like police, paramedics and fire rescue officials are most at risk for exposure to horrific circumstances in the course of their employment, which is why many states have specifically called them out as eligible for benefits. Florida is the most recent state to draft rules which would create additional clarity on establishing a list of qualifying conditions as required by the new statute; these include any exposure to injuries of a “nature that shocks the conscience” such as decapitation, exposure to internal organs, impalement, severance of a limb, or third-degree burns.

While other states have made changes to presumption of compensability for physical conditions like asbestosis, black lung or certain cancers, fewer states have yet acknowledged the harsh reality of the impact mental health has on our workers. Earlier this year Arizona, Kentucky, Minnesota, Missouri, South Carolina and West Virginia considered similar legislation on PTSD presumptions for first responders, yet no changes were enacted in these states. Based on the increasing visibility around mental-health-related claims, lawmakers in many other states will likely consider the issue again in 2019.

For a more in-depth exploration on how PTSD is impacting workers’ compensation, read Hero’s Welcome: Growing PTSD Coverage for First Responders.

California holds the fifth largest economy in the world and has the second highest overall system costs for workers’ compensation. It should therefore come as no surprise that California experiences a high level of workers’ comp regulation development. Here is a snapshot of some of the activity over the last few months and why it is important:

The state’s prescription drug monitoring program now requires all prescribers of schedule II-IV medications to check the database prior to prescribing opioids and other medications. Though CURES (Controlled Substance Utilization Review and Evaluation System) has been in place for 15 years, it wasn’t until 2016 that CURES received a boost in funding as part of the budget increase, and all prescribers and pharmacists have been required to register with it since then.

In related news, California rescheduled hydrocodone products from schedule III to schedule II. This change aligned California’s state laws with the federal law which reclassified these drugs in 2014. This is significant because the conflicts in state and federal law led to confusion for providers who are required to comply with state regulation on reporting to CURES.

The California Workers’ Compensation Insurance Rating Bureau (WCIRB) filed a rate decrease recommendation for the third consecutive year. The WCIRB also published a report highlighting the need for the state to crack down on providers using collected medical payment data from payers via its medical data call, analyzing the volume and type of care that was delivered by individuals who were later indicted or suspended for fraud-related activity.

According to WCIRB, 7% of all medical payments were made to providers who were later indicted for medical fraud. The proportion of medical lien payments to convicted providers increased by 130% between 2013-2017. Though enforcement efforts have been ramped up in recent years, there is clearly more work to be done in this area to identify and pursue these bad actors and remove them from our system.

Earlier this year, the Division of Workers’ Compensation (DWC) appointed its inaugural six-member Pharmacy & Therapeutics (P&T) Committee to consult with the DWC on updates to the drug formulary. The committee is comprised of three pharmacists and three physicians, each representing a unique sector of the workers’ compensation and healthcare system. The first meeting took place September 26th, discussing drug identifiers, therapeutic equivalents, and alternatives. Meeting materials are available online in the pharmacy section of the DWC site, and the next meeting is anticipated to be scheduled prior to the end of 2018.

California has new regulations both adopted and in the pipeline with informal comments being considered at this time. On September 27th, the DWC adopted amendments to the Official Medical Fee Schedule (OMFS) for Physician and Non-Physician Practitioner Service rules. The DWC replaced the average statewide geographic adjustment factor with a locality-specific geographic adjustment factor. These changes will become effective January 1, 2019. The new locality structure is intended to improve payment accuracy.

The DWC also proposed a change to the Pharmacy Reimbursement rules. The proposal conforms to the recent changes made in the state’s Medicaid program. These changes are estimated to reduce generic drug reimbursement to the equivalent of AWP minus 85- 95%. Most states workers’ comp pharmacy fee schedules set the reimbursement maximum for generic drugs at AWP minus 3% with an average dispense fee of $5.00.

In addition, insurers will now have to reimburse dispensing fees based on a complicated dual tiered dispensing fee tied to the individual pharmacy’s transaction volume from the prior calendar year, updated annually. This new reimbursement structure will require pharmacies to dispense medications at the pharmacy’s purchase cost, and in some cases below the purchase cost, not considering the value provided by PBMs in processing transactions, administering and compliance reporting related to the MTUS formulary, education and support for the prescriber, claim professional and employer on drug therapies, contraindications, and alternatives.

Healthesystems has provided input to the DWC, citing our concerns, and we will continue to stay engaged throughout the rulemaking process. Formal regulations and upcoming hearings are scheduled for the new rule in 2019.

Earlier this year, stakeholders in Florida began receiving amended determinations from the Florida Division of Workers’ Compensation (DWC) on old medical reimbursement disputes that dated back are far as 2013-2016. The amended determinations were prompted by a judge’s October 2017 decision which found that the DWC had not fulfilled its role in resolving fee disputes as outlined in F.A.C. 69L-31.016, a section of the workers’ compensation statutes that deals with how medical utilization disputes are handled.

The DWC changed its policy in late 2015 regarding how it would resolve medical fee disputes when issues of compensability, medical necessity, or matters related to a contractual agreement between the parties existed. The change in policy resulted in the DWC returning fee disputes which fell into these three areas back to the providers without making any determination, citing their lack of authority. This left providers with no other remedy and ultimately prompted them to file a challenge against the DWC. Several interested parties joined the suit, filing supporting arguments from the provider and the insurer community. The court later ruled in favor of the medical providers, determining the policy change and associated actions by the DWC were invalid exercises to self-limit the scope of the agency’s delegated legislative authority.

Due to this court decision, the Florida DWC staff have been reviewing prior petitions which had been improperly returned to providers in an effort to resolve any outstanding claims for additional medical reimbursement. Providers and insurers can expect it to be several months or longer before the DWC fully resolves the outstanding cases.

After years of debate and discussion on how and if a formulary would serve Louisiana’s workers’ comp system, the Office of Workers’ Compensation Administration (OWCA) is soliciting comments on an updated version of its chronic pain guidelines. The OWCA Medical Advisory Committee is requesting comments from the public prior to initiating any formal rulemaking. Given the timeline, if the guidelines were to be updated, the earliest possible time these would become effective would be in April 2019. Once a formal proposal is published along with a Notice of Intent, a public hearing will be scheduled.

The New York Compensation Insurance Rating Board (NYCIRB) recently hosted its second annual meeting which attracted a diverse cross section of the industry including actuaries, executive claims leaders, medical experts, and regulators. Attendees were treated to a look back at loss developments and trends, as well as a forecast based on recent legislative changes that will soon be enacted.

Ziv Kimmel, Senior Vice President and Chief Actuary, provided the 2018 State of the System Report, which reflected on the overall rate reduction, which was recommended as a result of recent legislative changes such as the cap on days to maximum medical improvement, and a new PTSD presumption for first responders.

NYCIRB also reported on a slow but steady reduction in opioid use; this was thought to be connected to the I-STOP legislation passed in 2013. In concert with statewide efforts to curb misuse of opioids, Workers’ Comp Board Chair Mary Beth Woods shared an update on the upcoming formulary proposal, which many anticipate will be adopted in late 2019 and will incorporate nationally recognized evidence-based treatment guidelines.

The Texas Department of Insurance recently released Access to Medical Care in the Texas Workers’ Compensation System, 2005–2017. This report examined injured workers’ access to medical care and set out to measure timeliness of care and Texas’ physician participation in the state’s Designated Doctor program. The report indicated that initial non–emergency treatment timeframes have improved slightly over the term of the study. More than 84% of patients are now receiving initial care in seven days or less as of 2016, in comparison to the beginning of the study when about 81% of patients received care within the first seven days of their accident.

Though this may seem like a small improvement, delayed initial care was correlated with higher total medical costs, meaning even slight improvements can lead to significant savings. Claims with initial care delayed beyond seven days had an average of 39% higher medical costs in the first six months after injury.

Interestingly, the number of participating designated doctors remained stable over the course of the study, while workers’ comp claims decreased by about 20% from 2005–2017. Also of note, in–network patients received their initial care in a shorter timeframe than out–of–network patients, yet all patients with extremity injuries received care faster than those with neck, low back, and shoulder injuries, independent of network status.